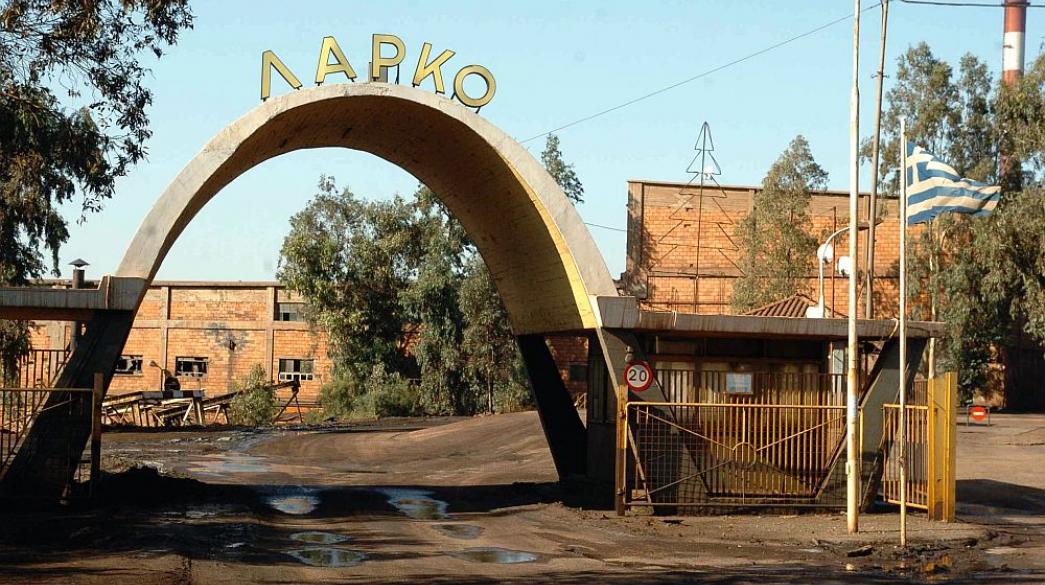

Investor interest in the main assets of Larco has been stronger-than-expected with six players showing initial interest in the tender including large Greek companies, such as GEK TERNA and Mytilineos, in addition to the Trafigura group, which has a dominant position in the global commodity market. However, as those who know the peculiarities of this privatization point out, the road ahead until a final deal is reached is long.

Despite being severely weakened with reduced production levels and under special management status, Larco’s assets attracted investment interest for two main reasons:

- Nickel is going through a very good period in the world market, reaching a 6-year high last month, at $18,244 / ton and has fallen slightly to the level of $17,600. After the big dive in March at the start of the pandemic, its price is heading upward again on stronger demand from China for stainless steel production. Forecasts for nickel demand in the coming years are generally positive, not only for the production of stainless steel, but also for use in electric car batteries. Larco produces ferro nickel and not pure nickel for batteries, but it is still the only unit in the European Union and its sale could hardly go unnoticed at this time.

- The privatization process chosen gives interested investors access to Larco’s assets without any hitches. Through the long-term lease of the Larymna factory and other assets, the investor who will prevail in the tender is not obliged to undertake any obligations of the company under liquidation, nor is it obliged to employ a minimum number of employees, or to determine remunerations levels based on Larco salaries. With this data, the investor can implement the business plan that he will draw up, without restrictions.

However, at this point the good news stops and concerns about the tender rise as Larco’s assets may be on offer but there are still serious issues as to whether interested parties will examine before deciding on a binding offer.

The first open issue is the cost of reopening the obsolete factory in Larymna. According to some estimates, in order for the plant to operate in full compliance with environmental regulations, investments of 100-200 million euros are required. It remains to be seen how many investors will still be interested once they have been fully informed of these costs.

The second issue hanging over the tender is the cost of electricity, which is the highest cost factor in the most energy-intensive industry in the country. There is ambiguity on this issue, as PPC has proposed a large tariff increase on Larco, to the order of 40% - 50%. For an investor who wants to draw up a business plan, which for the first time in many years will bring Larco production costs below the selling price of iron-nickel, the issue of electricity tariffs will be crucial in the final decisions.

Contributing to the complexity of the whole process is the fact that the tender does not include the mines exploited by Larco, which will be sold separately. The result of the two tenders will be identical, since an investor cannot lease the factory without having access to raw material from the mines.

Investors that have shown an initial interest in Larco’s assets are Commodity & Mining Insight Ireland Ltd., GEK TERNA in cooperation with the Swiss AD HOLDINGS AG, Mytilineos, Solway Investment Group Ltd, Tharisa Plc and Trafigoura Group.