Greek stocks are trailing well behind gains seen in government bonds that have been setting new records. In 2020, the upward trend on the Athens bourse has run out of steam with most shares having dropped from 52-week highs, despite strong demand for Greek government paper.

Exceptionally favorable conditions in the fixed income market in combination with improved economic conditions in Greece and high expectations for a good 2020 have driven yields to historic lows.

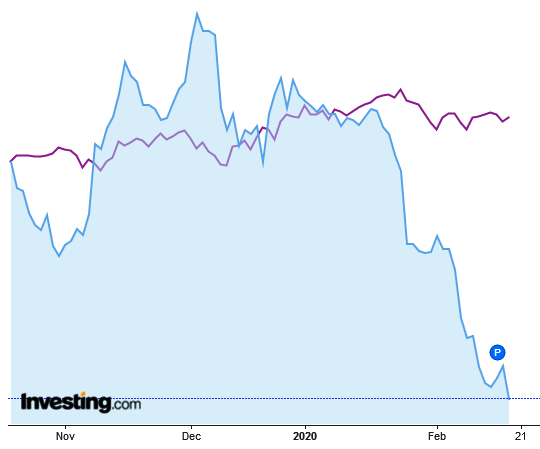

However, this optimism has not spilled over on to the stock market. The distance separating the stock and bond markets is obvious from the diagram below (Athens bourse general index in purple, the yield on Greek government bonds (GGBs) in blue). The general index has remained stagnant this year, while bond yields have plummetted by 36 percent.

Athens bourse general index versus yields on 10-year GGBs

Analysts point out that the performance of Greek bank shares must be separated from other stocks on the bourse due to specific conditions affecting the financial sector. They highlight that most large and mid-caps share have recorded strong gains in recent years and they are no longer seen by many as being cheap.

The benchmark general index, located at just over the 900 point mark, does not give an accurate picture of the broader market as it includes financials that have been under extra pressure. Bank stocks have yet to recover price levels at which lenders were recapitalized twice in recent years, reflecting challenges in the sector. If bank stocks had a smoother performance, the general index would today be over 2,000 points, analysts estimate.

In comparison with 2012, shares such as OTE, OPAP, Mytilineos, Jumbo, GEK TERNA, Viohalco, Terna Energeiaki, Fourlis, PPC, Aegean, Lamda Development have risen considerably and in some cases, have gained more than 1,000 percent (GEK TERNA, Sarantis, OTE).

A number of these companies are implementing large investment plans, boosting prospects.

Lamda's investment at Hellinikon, Aegean's fleet renewal, Mytilineo's energy investments, PPC's improvement plans, GEK TERNA's Kastelli airport project, large investments from OTE and Terna Energeiaki and strong performances from OPAP and Jumbo could justify further hikes in share price levels under the condition of course that the domestic and international economic environment remains supportive.

In the last few weeks, most large-cap shares have been in the red with Ellaktor giving up more than 33 percent from a peak hit in recent weeks, while Motor Oil, Eurobank, Mytilineos and Viohalco have retreated by more than 20 percent.

At the opposite end, shares in Terna Energeiaki are at a 52 week high, while IPTO (ADMIE), Titan, Opap, Coca Cola HBC and OTE are just off recent highs.

Bank blues

The situation is more complicated in the banking sector where stocks jumped more than 100 percent last year after being under enormous pressure in recent years.

Theoretically, the large drop in government bond yields should be a clear indication of improving economic conditions, in a development that would strongly favor banks stocks. But despite this, the sector is weighing on the broader market.

The first big issue relates to general doubts about the current model under which lenders operate at a global level. Changes in technology that are changing drastically the way lenders have been doing business for decades. Banks, in Europe in particular, are trying to broaden revenues and boost profits without much success as they also struggle to in a negative interest rate environment.

Reflective of this is that European bank shares are trading a book value of 0.5 to 0.6, at about half of that seen among US peers.

At a local level, Greek banks also have one more major obstacle: bad loans and an ambitious set of plans to reduce them. These plans helped fuel buying interest in 2019, however, investors now want to see results from their implementation.

Additionally, talks about technical problems arising with the Hercules Asset Protection Scheme, particularly on the risk levels that will be attached to securitized assets, and changes to rules protecting main residencies are creating further risks and uncertainties.

Investors want to see fresh data on how banks will move ahead in the coming quarters to determine their strategy on the sector.